Is Buying a Franchise During a Recession a Good Idea?

In 2008, the housing bubble burst, sending the U.S. economy reeling for several years.

In the Great Recession of 2008, the data shows us that the franchise industry suffered. However, unlike most industries, the franchise industry did not come to a screeching halt.

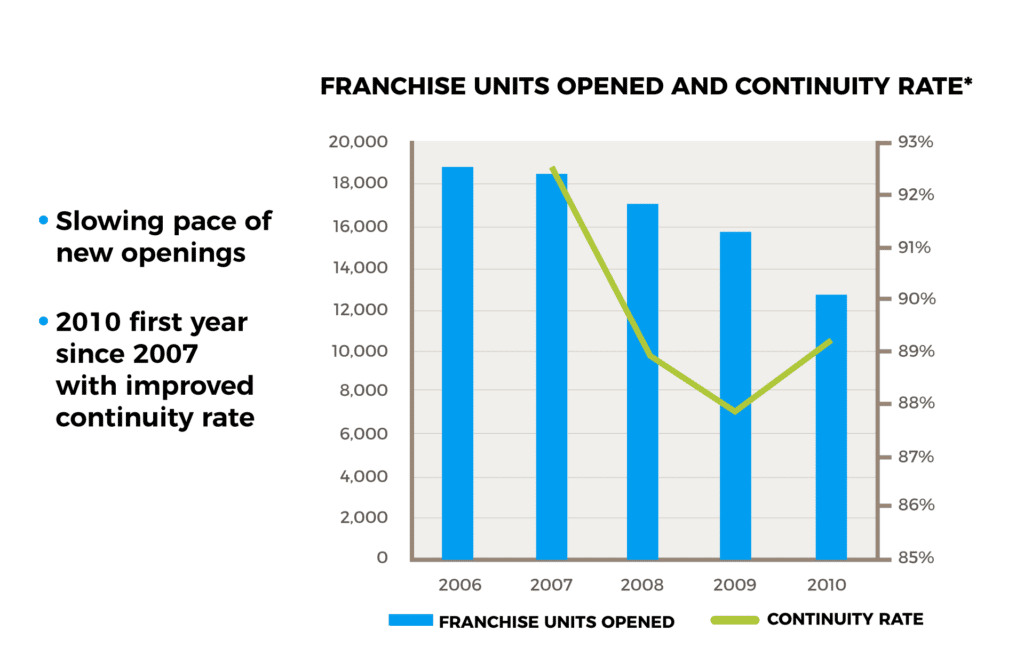

This can be observed by looking at the franchise industry’s overall continuity rate, or proportion of new franchise units that continued operation in the same location, which rapidly turned upwards in 2010, as we see in the chart below:

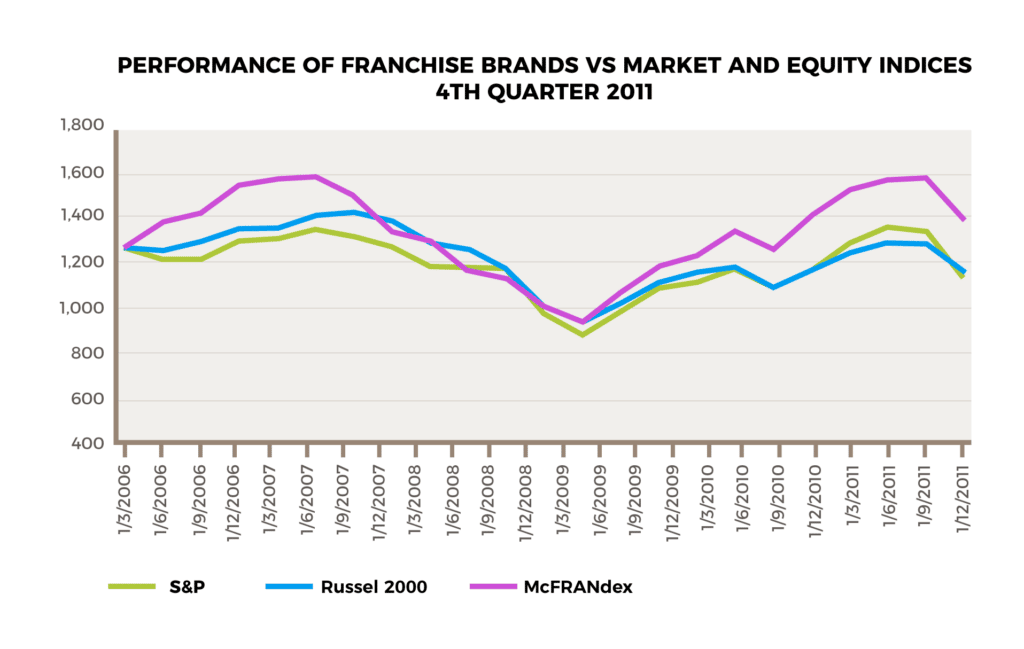

Indeed, the franchise industry seemed to outperform most other industries and major companies. A chart created by FRANdata – the most trusted data source in franchising – tracks the performance of a basket of franchise-related stocks and demonstrates how the franchise index outperformed the broader stock market indices from 2009 through 2011:

So why was the franchise industry seemingly more resilient than both independent business owners and the corporate model during the Great Recession? Simply put, the franchise model is built for survival through the strength of community.

Having a network of peers in terms of fellow Franchise Owners allowed franchise brands to quickly adapt to the new economic conditions faster, and ultimately recover faster. Specifically, quality franchise brands during the great recession were able to:

- Trial multiple marketing or sales strategies concurrently

- Benchmark results and adjust in local markets according to the data

- Drive volume discounts

As Corporate America had to lay off tens of thousands of employees due to not having the benefits that franchise brands are afforded mentioned above, more and more employees were cast aside and let go. Many of whom took note of how Franchise Owners were able to continue to operate successfully.

In 2008, we saw 16,000 new franchise openings, and approximately 13,000 new openings in 2009. Undoubtedly, a significant amount of these new franchises came from corporate refugees.

The data suggests that I’m not alone in my belief that a recession environment can be the best time for someone to finally take the leap and enter into Franchise Ownership. Indeed, we saw this yet again in the most recent recession, which occurred during a global pandemic.

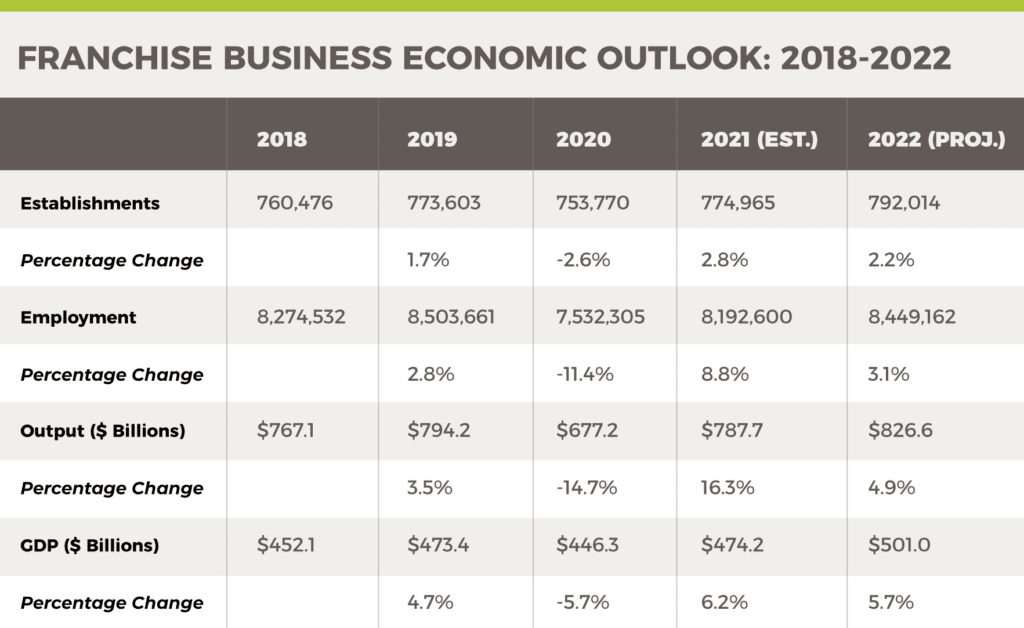

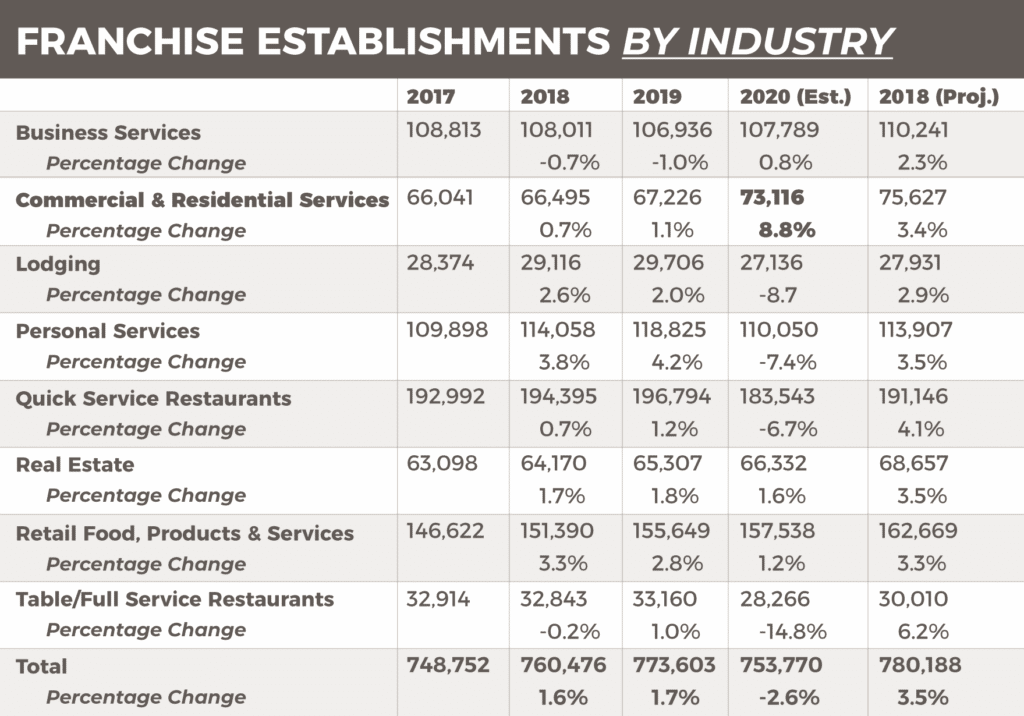

As the COVID-19 lockdowns and restrictions of 2020 started to cripple the economy, the franchise industry would go on to lose approximately 20,000 businesses, ending the year with an estimated total of 753,770 franchised establishments.

But what was impressive, nonetheless, was once again the recovery of the franchising industry.

According to FranData – in 2021 franchising created more jobs and had a more positive impact on the global economy than most other industries. The total output from franchises increased by 16.3% over 2020 to nearly $788 billion, exceeding 2018 numbers by over $20 billion. While the pandemic did real damage to most franchise businesses in 2020, the recovery of the franchise industry in general was nothing short of spectacular.

In this last downturn and many past recoveries, this type of data consistently pointed out that franchising has expanded faster than overall GDP. This is largely due to the fact that the franchise model’s unique structure allows for:

- Rapid hiring

- Faster business openings

- More predictable performance than independent businesses

Just like during the Great Recession, the experience of the COVID-19 recession wasn’t uniform across all franchise segments. As an initial wave of new Franchise Owners was created by large-scale corporate layoffs in Q3 of 2020, and then reinforced by a second wave of new Franchise Owners spurred on by the Great Resignation, service-related franchise brands became the industry that many of these corporate refugees ran to.

While many industries suffered losses of franchise businesses by an approximate average of 5%, the commercial and residential services sector actually expanded by an average of 8.8% during the worst year of the pandemic.

In other words, people bought more franchises of service brands during the pandemic than they did when times were good.

And it wasn’t just the franchisors of these service brands who benefited from growth. Franchise Owners of service brands likely enjoyed sales records and healthy balance sheets during a time when most other business owners were struggling to survive.

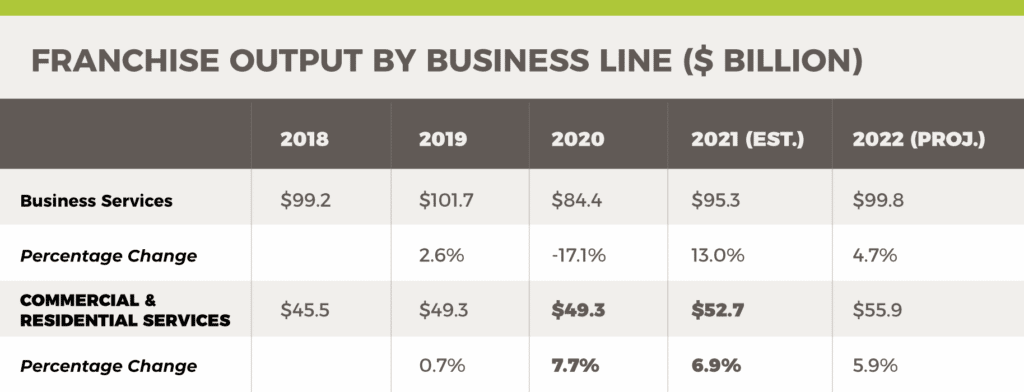

As we see in the chart below, commercial and home services were one of the only growth sectors in terms of output during the recession – with people spending 7.7% more on services in 2020, and 6.9% more in 2021. This was likely driven in part both by the fact that cash savings of Americans was at an all time high, and COVID-19 related lockdowns forced us to spend more time in our homes – and notice the imperfections or things we’d like to improve on more.

During a recessionary environment, service brands can be a great option for anyone who was laid off and is looking to replace or increase upon their earnings. The attractiveness of services brands during a recession come down to:

- Lower capital requirements to launch business

- Lower overhead and higher margins in some cases

- No buildout / construction – launch the business in a matter of weeks

- Many home services are a necessity that homeowners need to invest in

For this reason, many franchise experts or franchise consultants will push you away from food and retail-related franchises, and push you in the direction of a service brand in these types of economic climates. Indeed, I brought in three service brands into our portfolio of brands during 2020-2021.

The common rhetoric during the COVID-19 pandemic was that food franchising is in big trouble. That was true for a significant number of franchise brands, probably even the great majority of franchise brands.

However, almost all of the food-related brands within our portfolio painted a different narrative.

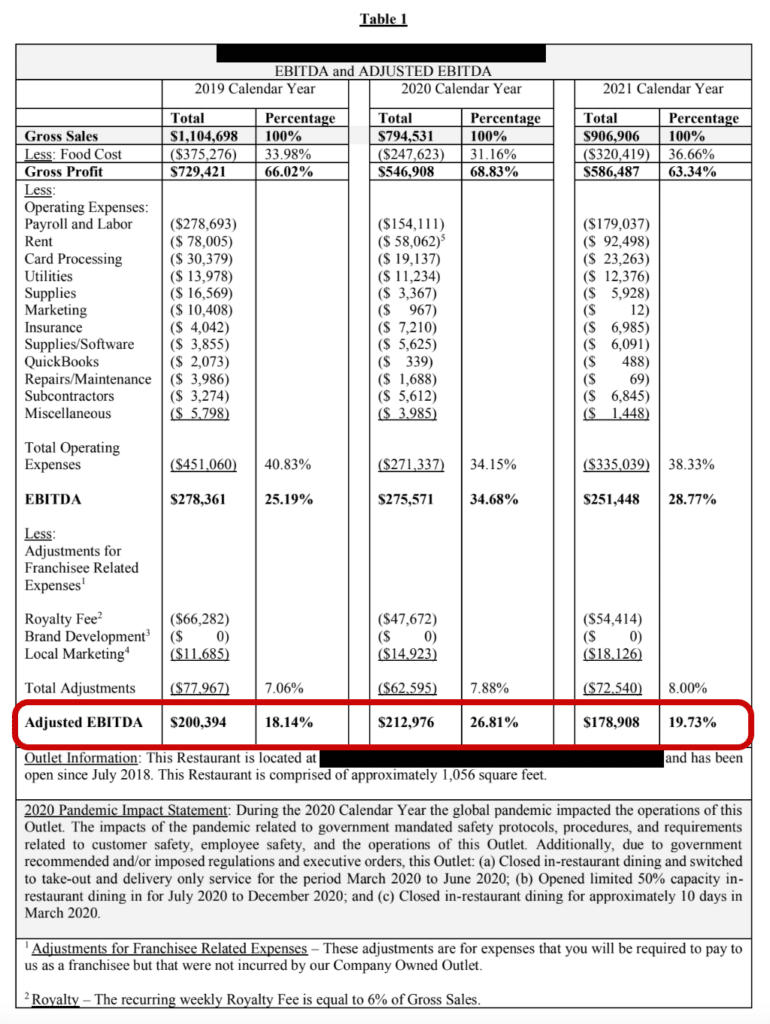

For example, we had one new franchise brand, a quick service restaurant (QSR) and grab-go model that offered breakfast toasts and smoothies. During the pandemic, the founder went from 1 to 3 open locations. The first location grew by 20% during the worst of it (2020). That one store generated $212,976 in net profit in 2020. Here’s the P&L for that brand:

The founder of this food-related franchise brand was able to take advantage of the favorable elements of a recessionary environment when starting a food, or any retail-related franchise business for that matter. Those being:

- Historically low interest rates

- More favorable real estate

- Fewer competitor

- An upcoming release of pent up demand

- Better deals on construction

It wasn’t just the Corporate locations, either, that benefited from the timing of opening a strong franchise model during a recession. The first open Franchise Owner saw similar success, going on to take $114,467* to the bank, not including the owner benefits this Franchise Owner would have realized. In the world of franchise (and business) ownership, it’s uncommon to generate 6 figures in net profit in the first year of business.

So how was the brand, like most Raintree brands in the food/retail industries, able to avoid the suffering that most franchises and businesses did during the pandemic? The answer is that they are truly elite franchise business models.

The intent of these articles is to arm you with the methodology and knowledge we use every day to identify winning brands like this, from mediocre or poor performers. This is the most important part of franchise success – simply picking the right brand. Doing so means that you’ll, at the very least, own a pandemic-resilient business that is more likely to perform well in all types of economic climates.

Keep in mind, since the end of World War II, the average recession has lasted on average only 10 months. The average term of a franchise agreement is 10 years. This means that the average recession will only impact about 10% of your Franchise Ownership experience. Picking a brand or segment because it performed well in recession should be a consideration, but not the ultimate deciding factor.

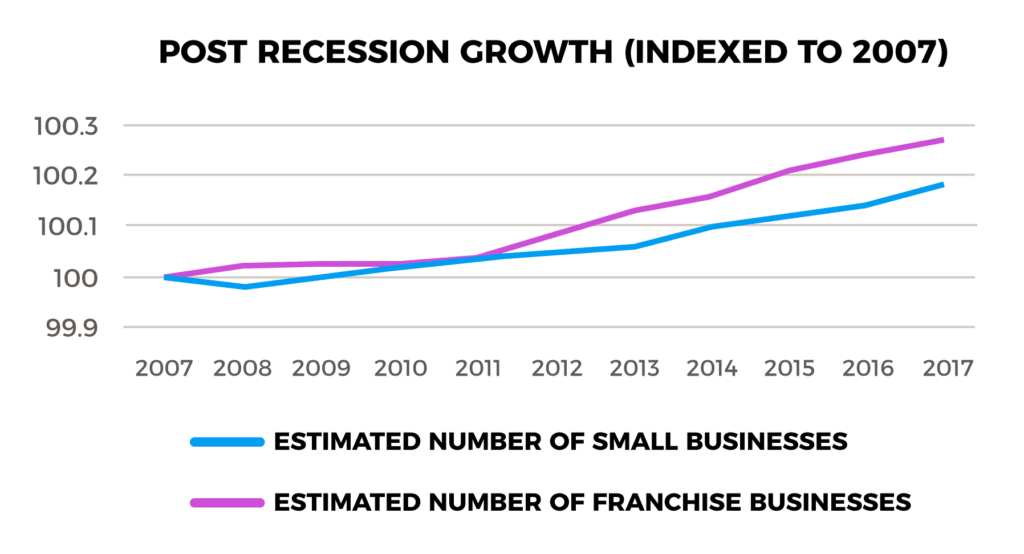

Indeed, the available data from the last two recessions discredits the idea that franchising is ‘recession-proof’, but both periods in time suggest that franchising weathered the storms better than independent business owners, and allowed for faster recoveries for Owners.

- The data supports the notion that franchising is proven to be recession-resistant

- Service related franchises proved to be a smart investment during the last recession

- Food related franchises have demonstrated an incredible ability to bounce-back

- Retail related franchise investment offers specific benefits only typically offered during a recession

- Corporate layoffs during both recessions led to significant new Franchise Owner growth

- Great franchise investments are absolutely available during a recessionary environment - to those who know how to find them

CHAPTER 2:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

1040 S Gaylord St.

Denver CO 80209

[email protected]